invest in rural hospitals across alabama

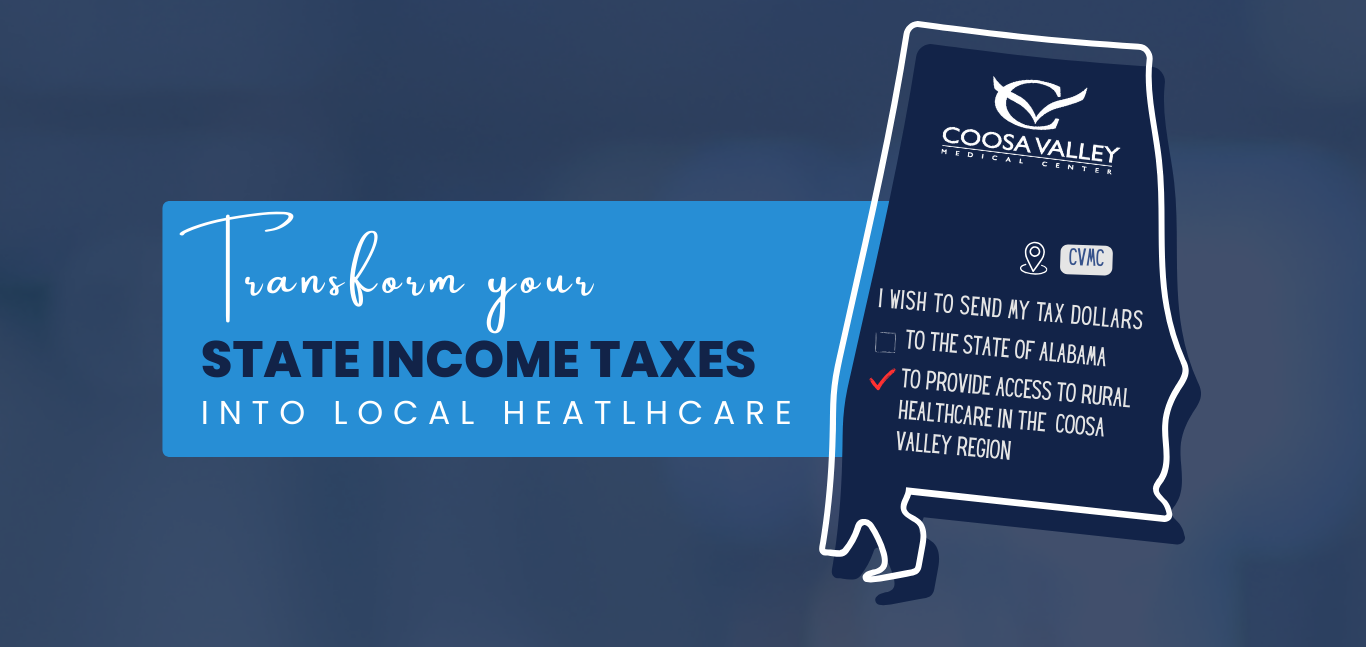

Rural hospitals are the heart of many Alabama communities. They provide around-the-clock care for families, support local jobs, and play a vital role in economic growth. Yet today, many rural hospitals face serious financial challenges that threaten access to care close to home.

The Alabama Rural Hospital Investment Program (RHIP) established by the Alabama Legislature in 2025 creates a powerful opportunity for individuals and businesses to make a meaningful difference. Beginning in January 2026, Alabama taxpayers can contribute to eligible rural hospitals and receive a full, dollar-for-dollar state tax credit.

Tax credits may be applied to income taxes, utility taxes, insurance premium taxes, and excise taxes, providing donors with flexibility while delivering critical support to rural healthcare facilities. Contributions may be made directly to a rural hospital or through an approved third-party organization that distributes funds based on financial need.

This year, you can support

Coosa Valley Medical Center through the Rural Hospital Investment Program, strengthening essential healthcare services in our community while receiving a dollar-for-dollar Alabama state tax credit.

PROGRAM DETAILS

Through RHIP, your contribution directly supports healthcare in our region while providing significant tax benefits. Contribution limits are set by donor type:

- Individuals: Up to $15,000

- Married couples filing jointly: Up to $30,000

- LLCs, S corporations, and partnerships: Up to $450,000

- Corporations: Up to $500,000

Eligible Taxes for the Credit

The RHIP tax credit may be applied against:

- Alabama income taxes

- Financial institution excise tax

- Insurance premium tax

- Utility taxes

Please note: To claim the credit against utility taxes, the taxpayer must hold a utility tax direct pay permit. This permit is available only to entities receiving multiple utility bills from a single utility company.

HOW TO RESERVE YOUR TAX CREDIT

Step 1: Reserve Your Tax Credit

- Reservations open January 5, 2026, for the 2026 tax year

- Submit your reservation through My Alabama Taxes

- Credits are allocated on a first-come, first-served basis, subject to statewide and hospital-specific caps.

Step 2: Designate Your Recipient

- Select Sylacauga Healthcare Authority DBA Coosa Valley Medical Center as the designated recipient of your tax credit.

Step 3: Make Your Contribution

- After securing a reservation, donors have 30 days to make a monetary contribution equal to the reserved amount.

- Contributions must be made directly to the designated hospital.

- Tax credits cannot exceed the reserved amount, even if a larger donation is made.

Step 4: Certification

- Within 30 days of receiving the contribution and no later than 60 days from the reservation date, the hospital must certify the donation through My Alabama Taxes.

Step 5: Receive Your Tax Credit Voucher

- Upon certification of your contribution by Coosa Valley Medical Center, the Alabama Department of Revenue will issue your tax credit, which may be claimed for the applicable tax year.

CONTACT US

If you have questions or would like assistance with reserving a tax credit, please contact the CVMC Foundation at foundation@cvhealth.net or (256) 401-4324.

Review this FAQ form for further information, or visit the ALDOR official website below.